🐋 Whale's Watch: How To Profit From Bitcoin $106,000 Drop

Good day, dear reader — Whale Investor here.

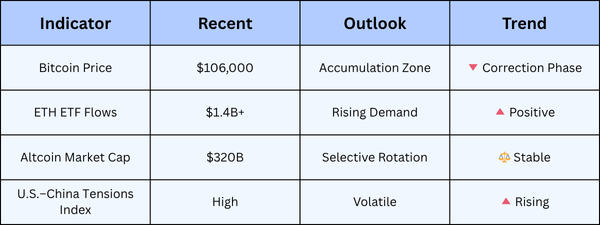

Bitcoin dips below $106,000 as headlines panic — but seasoned investors sense opportunity in the undercurrents. This moment marks a divergence: widespread fear contrasts with the foresight of those who understand deeper currents at play. The recent macro turbulence — triggered by renewed U.S.–China trade tensions and a surge in geopolitical risk — sent Bitcoin tumbling beneath the $106,000 threshold, rattling even seasoned traders. Yet beneath the chaos, a recalibration unfolds, one that savvy investors spot as fertile ground for the next phase of crypto’s evolving cycle.

The Market Undercurrent

The recent market dip is inseparable from the broader macro landscape, where U.S.–China tensions have escalated notably. President Trump’s latest announcement of a 100% tariff on Chinese imports set off a shockwave of volatility, rippling through commodity markets and crypto alike. This hardening trade environment disrupts capital flows and rattles institutional confidence, pressing bitcoin and other cryptos downward. Contributing to the pressure, significant ETF outflows signaled profit-taking and cautious repositioning by institutional holders.

Yet this correction defies panic’s finality; rather, it resembles a market recalibration. The sheer scale of liquidations — $1.2 billion wiped out over 24 hours — primarily targeting leveraged long traders, underscores the exhaustion of overly bullish positioning rather than foundational collapse. Trump’s simultaneous renewed interest in U.S. crypto infrastructure adds a nuanced twist, introducing a potent catalyst largely overlooked amid the noise. His endorsement hints at the emergence of domestic crypto policy initiatives that could strengthen infrastructure and institutional adoption in coming months.

History shows that every downturn births new leaders — typically those operating quietly beneath the surface, away from retail frenzy. The market’s undercurrent now favors utility-focused projects with institutional-ready liquidity over speculative memecoins. This evolution demands that investors broaden their radar toward high-conviction, under-the-radar assets positioned to benefit from strategic institutional shifts.

Ad by Boardwalk Flock

Bitcoin just slipped under $106,000 as U.S.–China tensions rattle the markets.

Retail is panicking. Headlines are chaotic.

But value-focused investors? They’re shifting attention—toward a coin already powering billions in on-chain trading volume.

It’s not Bitcoin. Not Ethereum. And definitely not DOGE.

This coin has quietly gained traction as a potential beneficiary of Trump’s renewed crypto focus.

It’s fast. Scalable. Still under the radar.

Inside Bryce Paul’s $3 report:

✅ Why this coin’s adoption is surging

✅ The market structure that supports its next move

✅ A checklist for identifying similar plays in early stages

Beyond the Hype: Strategic Analysis

This pivot frames a deeper reflection on how to think like a macro investor rather than a speculator. Institutional adoption is transitioning sharply — favoring cryptocurrencies with clear utility, robust infrastructure, and growth aligned with traditional finance. The growing convergence between ETFs, reserve-backed tokens, and decentralized rails signals a hybrid future where crypto integrates as core financial plumbing rather than an alternative sidebar.

The psychology of panic markets reveals another advantage for the calm capital: while retail traders sell in near-term fear, disciplined investors exploit the asymmetric payoff of strategically accumulating high-quality assets at cyclical lows. These investors understand that surface volatility masks steady, long-term currents of adoption, network growth, and regulatory clarity. They swim in deep water, harnessing patience and insight instead of chasing waves.

While the surface churns, the deep current is steady — and those who feel it early, profit quietly.

🌊 Whale’s Fact Break

The sperm whale can dive over 3,000 feet and stay submerged for more than an hour — patience and pressure tolerance few others can match. The same principle applies to market depth.

Discover what's on everyone's lips

🏦 The IRS Hopes You Never See This Trump Loophole - ad by American Alternative Assets

📺 The Video Musk Showed Trump — Now You Can See It - ad by Behind The Markets

💳 0% APR Cards Just Dropped. Pay Off Debt—Without Paying Interest - ad by Finance Buzz

💸 Trump Exposes the Silent Test of America’s New Money - ad by Reagan Gold Group

Data Snapshot 📊

Breaking News - Watch Full Video

Brownstone Research

Musk’s Starlink devices were confirmed installed in multiple federal buildings, quietly powering secure networks.

Former tech executive Jeff Brown believes this move sets up Elon’s first $1 trillion IPO — and he’s showing everyday Americans how to claim a stake for as little as $500.

🐋 Whale’s Final Word

Corrections like these veil opportunity. The key for long-term success lies in depth, not speed; in deliberate accumulation, not impulsive panic. True winners observe early, act with conviction, and navigate these turbulent tides with a calm, calculated approach.

Swim perceptive,

- Whale Investor 🐋