🐋 Whale’s Warning: The Digital Dollar Has Already Arrived

The Silent Rollout 🌊

While headlines scream about inflation, elections, and stock market swings, something far bigger is happening quietly in the background. The U.S. has already launched FedNow — a 24/7 instant payment system that most Americans barely know exists.

On the surface, it’s marketed as progress. Faster payments. More convenience. Modernization. But beneath the surface, these rails may be the foundation for something far more consequential: a Central Bank Digital Currency (CBDC).

This shift isn’t science fiction — it’s already here. And the decisions being made now could shape how every American saves, spends, and invests for decades to come.

Deep Dive

CBDCs aren’t the same as Bitcoin or Ethereum. Unlike decentralized crypto, which operates outside government control, CBDCs are issued and monitored directly by central banks. Every transaction becomes traceable. Every dollar programmable. That’s efficiency for regulators… but what about freedom for citizens?

Ask yourself: if money becomes programmable, who writes the rules? Could your access to funds be limited because of spending habits, political alignment, or simply being in the wrong sector at the wrong time?

And it’s not just theory. China already operates its own digital yuan. Europe is preparing the digital euro. Now the U.S. is quietly racing to catch up — and FedNow is proof the rails are already being laid.

Even Trump, once a critic of digital currencies, has started signaling support for a “crypto reserve.” If that evolves into a dollar-backed CBDC, the game changes overnight.

The question is simple: when the system is fully live, will you be able to opt out? Or will it be too late? The answer may depend on whether you take protective steps now — while alternatives are still available.

The Digital Dollar Is No Longer a Theory -

It's Already Here...

While America's distracted, the Fed quietly launched FedNow - a 24/7 instant payment system that's laying the foundation for a U.S. Central Bank Digital Currency (CBDC).

They claim it's about speed and convenience...

But beneath the surface, a system of surveillance and control is being built impacting our financial privacy and freedom.

Ask yourself:

- If every transaction becomes digital, what happens to your privacy?

- Could "programmable money" be used to limit how - or where - you spend?

- Could access to your savings or retirement be limited by someone else's rules?

This isn't hypothetical.

FedNow is already live. The rails are in place.

And even Trump - who once criticized digital currencies - is now supporting a national crypto reserve... and has adopted projects like Trump-themed tokens.

The writing is on the wall. Once this system is fully operational, opting out may no longer be an option. If adoption becomes widespread, preserving financial alternatives could become impossible.

That's why this free guide is so urgent. It reveals the real risks - and what you can do right now to protect your financial freedom before it's too late.

Get the guide now. While you still can.

Second Wave 🌊

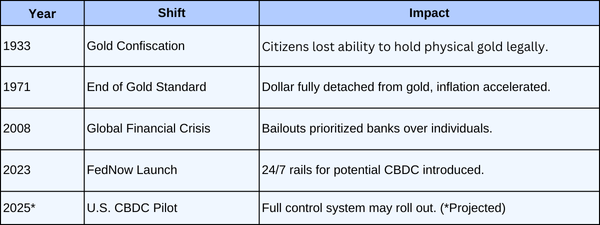

History teaches us that major monetary shifts don’t come with warning sirens. In 1933, Americans woke up to gold confiscation. In 1971, Nixon ended the gold standard in a single televised address. In 2008, banks collapsed while politicians promised “stability.”

The digital dollar may be the next flashpoint. And once it’s fully embedded, reversing course will be nearly impossible. That’s why smart investors are already exploring parallel systems of wealth protection — physical assets, private stores of value, and strategies that put distance between them and government-controlled money.

Because when privacy and freedom are the stakes, waiting until “everyone else notices” could be waiting too long.

🌊 Whale’s Fact Break

Did you know that sperm whales can hold their breath for up to 90 minutes while diving for food? They survive in silence, deep below the surface — just as the biggest shifts in finance often happen quietly, before anyone on the surface notices.

Data Snapshot 📊

Key milestones in financial control systems:

👉 FedNow is already live. The rails are in place. Get the guide now.

🐋 Whale’s Final Word

The tides are shifting — quietly, but powerfully. Don’t mistake silence for safety. In the ocean and in markets, the biggest moves happen below the surface. Stay alert, protect your freedom, and never swim with blinders on.

- Whales Investing 🐋