🐋 Whale's Warning: Stop Feeding Big Banks. Try This Instead👇

The Tide Is Shifting

For over a century, traditional banks have played the same game: charge hidden fees, profit from overdrafts, and slow down access to your own money. It worked in the old world. But today, investors and everyday savers alike are demanding something better.

And the tide is finally shifting.

Deep Dive

Think about how much money banks quietly skim off their customers every year. Overdraft fees, minimum balance penalties, monthly maintenance charges — they’re designed to make banking profitable for the bank, not for you.

In 2023 alone, Americans paid more than $11 billion in overdraft fees. That’s not innovation. That’s exploitation.

But a new wave of financial technology is breaking that cycle. Challenger banks and digital-first platforms are rewriting the rules, building systems where the customer — not the institution — is at the center. They move faster, cost less, and give people tools to actually build financial stability.

This isn’t just convenience. It’s financial freedom.

The Bridge

A colleague recently pointed me toward a platform that embodies this shift. Instead of nickel-and-diming you with hidden charges, it helps you keep more of your money, pay yourself faster, and build credit safely.

And for many, it could mean the end of traditional banking headaches.

Stop Paying Bank Fees. Start Banking Smarter.

More control. Less friction.

Traditional banks make money when you make mistakes. That stops here.

Chime® gives you modern banking that feels fair. Keep more of your money and move faster.

- No monthly fees or minimums

- Get paid up to 2 days early with direct deposit

- Tools that help build credit without the trap

- Real-time alerts so you are never in the dark

P.S. Every fee you avoid is money back in your pocket.

Second Wave 🌊

Every financial revolution begins quietly. Online shopping was dismissed as a fad until Amazon dominated. Streaming was laughed off until Netflix rewrote entertainment. Banking is now facing that same moment of disruption.

The institutions that survive will be the ones that put customers first. And for those who adopt these tools early, the benefits add up year after year — fewer fees, smarter tools, and more money in your pocket where it belongs.

The choice is simple: keep funding the old system, or join the new one built to work for you.

Data Snapshot 📊

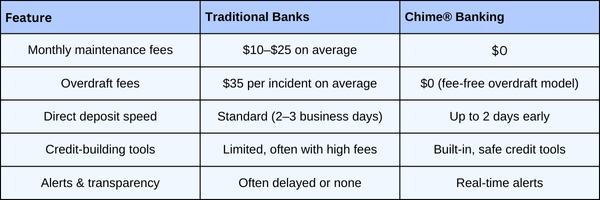

Comparison of traditional banks vs. Chime®:

🌊 Whale’s Fact Break

Did you know the blue whale consumes up to 4 tons of food per day? Like big banks, their appetite is massive — but you don’t have to keep feeding it.

🐋 Whale’s Final Word

The future of money doesn’t punish mistakes — it empowers smarter choices. Stop funding the system that profits from your pain. Ride the tide toward banking that finally feels fair.

- Whales Investing 🐋