🐋 Whale’s Tax Hack: The Hidden IRS Raft to Survive the Next Crash

The Silent Wave 🌊

Every cycle feels different, but the outcome is the same. Markets boom, investors grow complacent… and then the tide turns faster than most can react.

Already, the signs are everywhere: banks shuttering branches, the Treasury flashing debt warnings, household names closing restaurants. These are not isolated events. They’re tremors before the quake.

And through it all, retirement accounts — the nest eggs millions depend on — remain strapped to the deck of a ship taking on water.

But insiders? They’ve already found their lifeboat.

Deep Dive

It’s no coincidence that in every downturn, some investors barely flinch while others are wiped out. The difference isn’t luck — it’s preparation.

Hidden inside the IRS code, Section 408(m) allows Americans with accounts like 401(k)s, IRAs, TSPs, and 403(b)s to reposition without penalty, without triggering taxes, and without cashing out into a failing system. It’s not a loophole in the sense of a trick — it’s a provision designed for those who know how to use it.

The wealthy do. Wall Street insiders do. That’s why when markets tumble, they’re not the ones calling their brokers in panic. They’re using structures like 408(m) to quietly shield and grow wealth, while the average investor is left wondering what went wrong.

The most important truth? You don’t have to be an insider to act like one. This provision is public — just ignored by the very people who’d prefer you stay exposed.

So you can either ride the next wave down… or learn how to grab the raft before it’s too late.

Will You Hold Tight... or Grab the Raft?

It's happening again - but this time, it's faster.

- ✅ Banks are quietly closing branches across the country.

- ✅ The Treasury is signaling deeper debt problems.

- ✅ Major restaurant chains are closing locations.

- ✅ Stock market volatility is rattling portfolios daily.

And through it all... your retirement stays fully exposed?

You have two options:

- ✅ Hold tight and ride it down - like millions did in 2008 and 2020.

- ✅ Or grab the raft that more informed investors are quietly using to stay afloat.

Here's what few are talking about - but the wealthy already know:

Never heard of it? That's the point.

This IRS-backed provision allows qualified Americans to reposition a portion of their 401(k), IRA, TSP, or 403(b) - without penalties, without moving to cash, and without staying fully exposed to a system that's clearly shaking.

No hype.

Just protection, privacy, and a strategy Wall Street rarely mentions.

Request your FREE 408(m) Guide now and uncover how this little-known IRS rule could be the raft that helps you ride out the next wave - before it's too late.

Second Wave 🌊

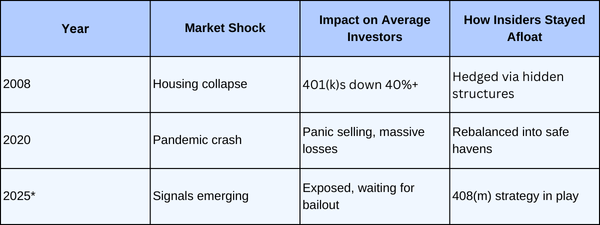

History doesn’t repeat exactly, but it rhymes. In 2008, millions “held tight” and watched years of savings evaporate. In 2020, the story repeated in a matter of weeks. Each time, the same pattern emerged: insiders surfaced stronger, while ordinary investors scrambled.

The signals today look eerily familiar. And if the tide is turning again, the question isn’t whether to act — but how quickly.

Because once the wave hits, the window to grab your raft will slam shut.

🌊 Whale’s Fact Break

Did you know whales can reduce their heartbeats to just 2 beats per minute while diving deep? Survival isn’t about speed — it’s about conserving strength until the moment counts.

Data Snapshot 📊

*Projections based on current macro trends.

👉 Grab the raft that more informed investors are quietly using. Get the guide now.

🐋 Whale’s Final Word

The ocean always reminds us: storms aren’t avoidable, but survival is a choice. Section 408(m) is the raft most won’t see until it’s already too late. The whale has spotted it. Will you swim toward it — or sink with the crowd?

- Whales Investing 🐋