🐋 Whale's Tax-Free Income Hack: Unlock the IRS 408(m) Loophole

The Tide Is Shifting

For decades, retirement savers have played by the same rules: contribute to a 401(k), IRA, TSP, or 403(b), then watch as the IRS takes a bite out of every gain. But deep below the surface, a hidden current has been flowing — one that only insiders have quietly tapped into.

It’s called 408(m). And it changes everything.

Deep Dive

Most Americans have never even heard of IRS code 408(m). But for the wealthy, it’s an open secret.

This loophole allows you to unlock tax-free income directly from retirement accounts — not once you’re 72, not after years of waiting, but now. Think of it as a “second paycheck” that flows alongside your existing income streams. Monthly, even weekly.

The best part? You don’t need to cash out, face early withdrawal penalties, or play IRS roulette. The strategy is IRS-approved, fully legal, and specifically designed to keep investors both shielded and invested.

Meanwhile, the vast majority of retirement savers remain exposed. They withdraw the traditional way, pay taxes, and watch as Wall Street and Washington siphon off what should have been theirs to keep.

History has shown that when loopholes like this exist, those who move early reap the rewards. By the time the mainstream hears about it, the best opportunities are often gone.

👉 There is an IRS loophole—408(m)—that lets you pull monthly or weekly income from your 401(k), IRA, TSP or 403(b) completely tax-free. Learn more now.

The Bridge

A colleague of mine who has been studying this loophole for years recently handed me a guide that lays out the entire strategy in plain English. No jargon. No games. Just the exact steps to start building your tax-free retirement paycheck.

And after reading it, one thing is clear: ignoring 408(m) is a mistake most Americans can’t afford to make.

Did you know there’s an IRS loophole—408(m)—that lets you pull monthly or weekly income from your 401(k), IRA, TSP or 403(b) completely tax-free?

Most Americans have never even heard of it. Yet the wealthy use it to shield gains, avoid penalties and stay fully invested—while everyone else sits exposed.

This isn't a theory. It’s a legal, IRS-approved strategy that can put a second, tax-free paycheck in your pocket—no cash conversion, no red tape, no catching penalties.

Grab your FREE 408(m) Guide now

Stay protected when the next crash hits.

P.S. Wall Street won’t tell you about 408(m). The insiders move first. Claim your guide (and bonus gold coin) before everyone else wakes up.

Second Wave 🌊

Imagine the next market downturn. Most retirees will see account balances tumble, then face a tax bill when they finally withdraw funds. But those using 408(m) will already have their system in place: tax-free income, steady flows, and peace of mind knowing the IRS can’t touch it.

The beauty of 408(m) isn’t just in the income. It’s in the flexibility. It allows investors to stay fully invested in assets that historically weather crises — while still drawing the income they need to live.

It’s no wonder insiders guard this knowledge so closely. But today, it’s available to those willing to look beneath the surface.

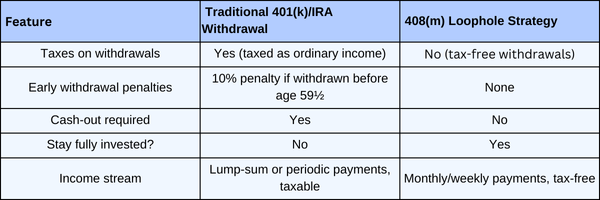

Data Snapshot 📊

Comparison of traditional withdrawals vs. 408(m) strategy:

🌊 Whale’s Fact Break

Did you know the bowhead whale can live for over 200 years — longer than any other mammal?

Longevity comes from knowing how to survive in harsh conditions. The same is true for wealth.

🐋 Whale’s Final Word

The IRS isn’t going to knock on your door and hand you 408(m). Wall Street won’t advertise it either. But the smart investor doesn’t wait for permission — they act. Because when the tide shifts, those who prepared are the ones who thrive.

- Whales Investing 🐋