🐋 Whale’s Signal: This Legal Gold Loophole Is Making Wall Street Panic

Wall Street’s biggest fear isn’t recession…

It’s you waking up.

Because deep in the IRS tax code sits a retirement game-changer: Section 408(m).

This rule allows Americans to move part of their retirement into physical gold — completely legally, and without taxes or penalties.

✔ No brokerage fees

✔ No Wall Street exposure

✔ No digital dollars or paper promises

Just real, tangible gold.

And here’s what makes it worse (for them):

Anyone can do it.

Even if you’re not ultra-wealthy.

With talk of a digital dollar rollout, foreign banks dumping U.S. treasuries, and gold quietly outperforming the S&P, the 408(m) move is catching fire among Americans who are tired of playing the rigged game.

This free guide shows exactly how to do it.

Good day, dear reader — Whale Investor here.

Beneath the calm surface of the markets, something profound is stirring. While the financial headlines remain preoccupied with interest rates, recession fears, and market rallies, the deeper, more relentless current is about trust — or more accurately, the crumbling of it. For decades, Americans handed their wealth off to a system built on leverage, paper promises, and digital abstractions. But now, a quiet rebellion is taking shape. Not on the streets, nor in screaming headlines, but within retirement accounts, where savvy investors are discovering that the game has always had a hidden rulebook.

That rulebook begins with something many investors overlook—Section 408(m) of the U.S. tax code. It’s a paragraph Wall Street would prefer you never read, yet it offers a legal pathway to hold physical gold within certain types of retirement accounts—free from capital gains tax and penalties when done properly.

🌊 The First Wave: Section 408(m) and the Legal Gold Migration

Section 408(m) officially outlines what types of precious metals are eligible for Individual Retirement Accounts (IRAs) and related structures. It specifies gold, silver, platinum, and palladium bullion and coins of certain standards and fineness—metals that must be physically held by an IRS-approved trustee or custodian. This legal framework opens a rarely-discussed door: Americans can directly hold physical gold—not just paper claims or ETFs—inside a retirement account.

The significance? Unlike stock holdings that ride the rollercoaster of Wall Street, or digital fiat currency that can be manipulated or even frozen, physical gold held under 408(m) remains impervious to market volatility and policy whims. Properly administered, these holdings are free from capital gains tax and early withdrawal penalties, a fortress against the growing fragility of today’s financial system.

Contrast this with the current landscape. Central banks internationally are racing to roll out digital dollar pilots, testing frameworks that could potentially increase government oversight, reduce privacy, and threaten financial autonomy. Meanwhile, foreign institutions quietly offload trillions of U.S. debt instruments, eroding the traditional safety nets that Americans have long relied upon. In this backdrop, gold quietly outperforms tech stocks and broad indices in sustained resilience.

If Wall Street’s greatest fear isn’t a market crash, it is your independence — the ability to hold tangible value impossible to confiscate, freeze, or dilute.

Deep Dive: Historical Cycles and the New Financial Depths

History is a powerful teacher if one listens to its currents. The collapse of Bretton Woods in 1971 marked the birth of fiat money’s dominance but also planted the seeds for recurring monetary stress and inflation spikes. The stagflation of the late 1970s brought investors rushing back into metals—gold surged as paper money faltered. The 2008 financial crisis again cast gold as the ultimate refuge, with investors fleeing from Wall Street’s systemic risk to bullion vaults worldwide.

Now, in 2025, monetary fatigue and structural debt have pushed the world into a new cycle. Record central bank purchases of gold — surpassing 1,100 tons globally — reflect a strategic preparation against fiat debasement. At the same time, bonds once seen as rock-solid are now viewed with growing wariness, with yields fluctuating and liquidity under pressure. The specter of Central Bank Digital Currencies, or CBDCs, introduces new anxieties — digital money that could impose controls over spending, raise privacy concerns, and even threaten financial sovereignty.

In these deeper waters, physical gold is no longer just a hedge. It’s becoming a form of quiet autonomy, a way to reclaim control in an era where monetary power is in flux. When institutions begin storing gold by the ton, it’s not nostalgia—it’s preparation.

They said it would “modernize” our financial system.

But the truth? The so-called Digital Dollar isn’t progress — it’s a trap.

Once it launches, the government could:

- Track and control every cent you spend

- Freeze your account with one click

- Dictate what you’re allowed (or not allowed) to buy

This isn't a theory. It’s already happening behind closed doors. And millions of hardworking Americans will be blindsided.

The good news? You still have time to protect yourself — if you act before the switch flips.

That’s why we put together an urgent guide: The Digital Dollar Trap.

Inside, you’ll learn exactly what this means for your savings — and the smart moves you can make now to stay two steps ahead.

Don’t wait until the trap snaps shut. Once it’s official, it’ll be too late.

Click here now to get your FREE guide before it disappears

🌊 Whale’s Fact Break

Humpback whales migrate up to 10,000 miles each year—but they always return to familiar depths when storms rise. The smartest journeys circle back to what’s real.

Second Wave: The Individual’s Path Beneath the Surface 🌊

While institutions make their large, quiet moves, American investors are not left waiting on the sidelines. Increasingly, individuals are discovering lawful, tax-advantaged ways to shield part of their retirement savings from systemic risks by turning to physical precious metals through Section 408(m).

This isn’t about rebellion against the system—it is pragmatic adaptation. It’s a choice to move resources from abstract, invisible digital fiat—and the servers, regulations, and surveillance that come with it—to something tangible, held in trusted vaults, beyond the reach of market turmoil or digital freeze. Unlike digital money, one cannot hack or seize gold through a switch in policy.

But caution is paramount. IRS rules are exacting: gold held in retirement accounts must meet specific criteria for purity, be held by approved custodians, and must never be stored personally to maintain tax advantages. Violations trigger severe tax penalties, so expert guidance and adherence to the law are vital.

The contrast is stark. One system depends on algorithms and regulatory goodwill; the other on raw, physical substance. In every monetary distortion across history, real wealth moves quietly below the surface, often before the broader market even senses the change.

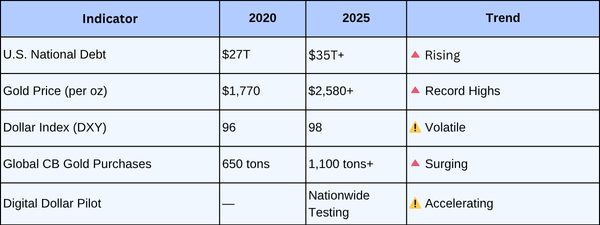

Data Snapshot 📊

Top Picks

🆓 Grab your Free Bitcoin! Just attend one of this week’s exclusive workshops, immerse yourself in the knowledge, and complete a short quiz completely free – no catch, no purchase necessary - ad by Goodrise

🚨 Trump’s Rebate Stimulus Just Dropped — Get your FREE 2025 Gold Protection Guide now. - ad by American Hartford Gold

📖 Free Crypto Revolution book from hosts of the world’s largest crypto podcast, CRYPTO 101! - ad by Boardwalk Flock

📋 Get Hugh Grossman's The “Daily Payout” Plan With a 91% win-rate on their trades! - ad by Eagle Pub

Allegiance Gold

Request Your FREE 408(m) Guide Today and discover how others are using this overlooked tax rule

🐋 Whale’s Final Word

We are in the midst of a profound monetary identity shift—from abstract digital promises back to tangible substance, from faith to proof. As governments and central banks scramble to patch credibility gaps, the wisest investors recalibrate their portfolios toward what policy and politics cannot easily touch.

The section of the IRS code known as 408(m) is quietly empowering Americans to reclaim financial independence, making physical gold a key pillar of retirement preservation. It’s a move that requires both discipline and foresight—a calm journey beneath the roiling waves above.

The deepest currents often run unseen and unheralded, but those who understand and navigate them emerge not only intact but stronger. This is one of those moments.

Swim chill, if you got your Free Guide,

- Whale Investor 🐋