🐋 Whale’s Outlook: The Quiet Gold Migration Has Begun

A Golden Undercurrent 🌊

Good day, dear reader. Whale Investor here.

Markets may look noisy on the surface — rates frozen, debt spiraling, politicians bickering. But beneath the turbulence, I’m watching a different current: a steady migration of wealth into one of history’s oldest safe harbors — gold.

And what’s striking this time is not just who’s moving, but how they’re doing it. A little-known IRS provision is quietly opening the door for everyday Americans to reposition retirement savings into physical gold… tax-free.

This isn’t theory. It’s not a loophole Congress will suddenly close tomorrow. It’s written in the code — and it could be one of the most underutilized tools in modern retirement planning.

Deep Dive

Most retirement savers still think of their 401(k) or IRA as a “locked box” — chained to the stock market, exposed to every twist in interest rates, and impossible to shield without taking penalties.

But there’s a little-known section of the IRS code — Rule 408(m) — that changes that picture entirely. Instead of being stuck in paper promises, it allows part of a retirement account to be reallocated into physical gold and silver. No tax hit, no early withdrawal fee, and no need to cash out.

This isn’t a Wall Street product. It’s an IRS-sanctioned structure that’s been hiding in plain sight for years, mostly known by attorneys, private wealth managers, and the wealthy who prefer to diversify quietly.

Why does it matter right now? Because the backdrop is deteriorating fast: inflation refuses to settle, Washington keeps layering on debt, and central banks worldwide are hoarding bullion at record pace. Savers who remain entirely in dollar-denominated assets could be watching their purchasing power erode while insiders migrate to harder money.

In other words — the window to reposition before the next shock isn’t just open, it may be narrowing.👇

Markets are chaotic.

Rates are frozen.

Debt is spiraling.

And now, more Americans than ever are searching for a safer way to retire.

Enter IRS Rule 408(m) — a little-known provision that lets you move a portion of your IRA or 401(k) into real, physical gold, without paying taxes or penalties.

It’s simple.

It’s fully IRS-compliant.

And it’s finally being talked about.

Why now?

✅ Inflation still isn't under control

✅ The Federal Reserve is boxed in

✅ The global move toward gold-backed assets is accelerating

✅ And U.S. retirees are sitting on trillions in exposed savings

This isn’t a trend. It’s a quiet wealth migration.

And it’s gaining speed every month.

Get the full details now — before the next financial shock hits and the window closes for good.

Second Wave 🌊

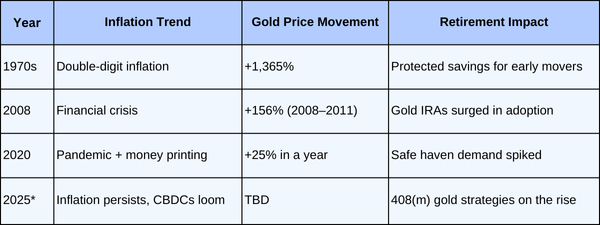

In every financial upheaval, those who moved early into hard assets slept better at night. From the gold rush of the 1970s to the post-2008 flight to safety, history shows us one truth: gold becomes not just an asset, but insurance against systemic uncertainty.

Today’s retirees face a unique moment. For once, Washington’s own tax code — not Wall Street’s marketing machine — is the one pointing toward gold. That alone should turn heads.

🌊 Whale’s Fact Break

Did you know a blue whale’s tongue weighs as much as an elephant? In markets, like in nature, weight matters — and right now, gold is quietly regaining its weight in global finance.

Data Snapshot 📊

*Projections based on current trends.

👉 P.S. Request Your FREE 408(m) Guide Today and discover how others are using this overlooked tax rule to protect their retirement - with real, tangible value.

🐋 Whale’s Final Word

In turbulent waters, the strongest swimmers know when to dive deeper for calmer currents. Gold, through 408(m), offers exactly that. Quiet. Steady. Resilient.

The tide of wealth is shifting. The only question is: will you ride it, or let it pass?

Swim safe,

- Whale Investor 🐋