🐋 Whale's Insight: Will StableCoin Spark a Dollar Reset?⚠️

The Tide Is Shifting

Imagine this: you wake up tomorrow and the rules of money have changed overnight. What you thought was safe — your savings, your retirement, even the value of the dollar itself — suddenly feels less certain.

That storm isn’t years away. It’s already forming.

Deep Dive

StableCoin isn’t just another digital experiment. It’s the trial balloon for a bigger idea: a dollar reset. Pair it with FedNow — the digital pipeline launched in 2023 — and the next step is clear: mass adoption of programmable money.

They’ll call it “convenience.” But what it really means is control. Every transaction logged. Every dollar programmable. Every account vulnerable to being throttled at the push of a button.

President Trump’s 401(k) policy shift is being brushed off as minor. But seasoned investors know better. It’s a signal. A warning siren that paper assets like stocks and bonds — the same ones millions of retirees are depending on — may no longer be enough to keep you safe.

Meanwhile, central banks worldwide are doing something different. They’re dumping dollars and hoarding gold. Citibank, Goldman Sachs, Bloomberg, and JPMorgan are all projecting gold could reach $4,000… even $6,000. Why? Because they know the dollar’s foundation is cracking.

The Bridge

A colleague of mine recently put it bluntly: “Paper assets are sandcastles. They look strong, until the tide comes in.”

And the tide is already rising. That’s why more and more Americans are looking beyond Wall Street — and back toward gold and silver, the bedrock that has survived every reset in history.

Will StableCoin Trigger a Dollar Reset?

Why Trump's 401(k) Shift Matters - And What the Market Isn't Telling Retirees.

Imagine this: You wake up one morning and the rules of money have changed overnight. That storm is already forming.

- StableCoin is the trial balloon - whispers of a coming dollar reset.

- The Fed already rolled out FedNow — a digital pipeline for money. Next step? Mass adoption. They’ll sell it to you as “convenience,” but what they really want is control over your privacy.

- President Trump's 401(k) shift isn't some small change. It’s a warning siren that paper assets like stocks and bonds may no longer be enough to protect your retirement.

- Central banks worldwide are dumping dollars and buying gold. Even the biggest U.S. banks — Citibank, Goldman Sachs, Bloomberg, JPMorgan — are saying gold could hit $4,000… even $6,000. Why? Because they know the truth: the dollar is cracking.

Think of it this way:

- Paper assets are like sandcastles. They look strong… until the tide comes in and washes them away.

- Gold and silver are like bedrock. They’ve stood strong through every storm, every reset, every crisis in history.

The media keeps cheering about “market highs.” But under the surface is the real story: sky-high debt, inflation that won’t quit, and dangerous volatility. Even the author of 'Black Swan' recently said that the debt and dollar reset 'crisis' is looming.

For retirees, the biggest threat isn’t what you see on TV. It’s the trapdoor waiting to open beneath you.

That’s why more and more Americans are turning to Gold and Silver. Because metals don’t play politics. They don’t depend on Wall Street games. They’ve survived every reset in history — and they’re ready to protect your wealth again.

Request your FREE Protection Guide now - before whispers of a reset turn into tomorrow’s headlines.

Second Wave 🌊

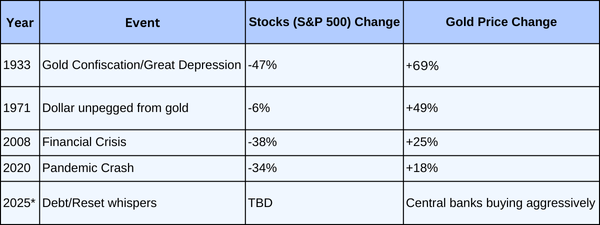

Think back to every major reset in history.

- 1933: Gold confiscated, citizens left with paper.

- 1971: Dollar cut from gold, inflation unleashed.

- 2008: Bailouts saved Wall Street, but savers paid the price.

Each time, ordinary Americans were the ones blindsided. Each time, those holding metals weathered the storm.

Today’s environment is no different. With debt spiraling, inflation sticky, and digital money experiments moving forward, the trapdoor beneath retirement portfolios is opening wider. The question isn’t if a reset will happen — it’s whether you’ll be prepared before it does.

🌊 Whale’s Fact Break

Did you know whales can sense shifts in ocean currents long before storms hit the surface? Investors who tune into the undercurrents of money often survive the storms others never saw coming.

Data Snapshot 📊

Gold vs. Paper Assets in Crisis Years:

*Projected environment, based on current trends.

🐋 Whale’s Final Word

Paper assets may look like castles. But castles made of sand don’t survive the tide. Gold and silver aren’t just assets — they’re anchors. And when the dollar resets, anchors are what keep you from being swept away.

- Whales Investing 🐋