🐋 Whale’s Insight: The Tax Play Hidden in Shadow of Gov-Shutdown

Washington on Pause

Good day, dear reader — Whale Investor here.

The headlines scream about shutdowns, spending fights, and budget chaos. But beneath all that noise lies a quieter truth: the government doesn’t stop collecting from you. Tax receipts flow in every day, even as Washington itself grinds to a halt.

Here’s the problem: most hardworking Americans pay far more than they should. Not because they want to — but because they’ve never been told about the strategies the wealthy use. These aren’t shady tricks. They’re legal, IRS-approved provisions that have existed for decades… but rarely make it to the evening news.

While the middle class waits in line and writes bigger checks, high-net-worth families quietly protect their wealth, cut liabilities, and pass down more to the next generation. Why? Because they know how to leverage the system — and the system rewards those who play the game.

And right now, with Washington desperate for revenue and looking under every rock for “new funding,” loopholes like these are in the crosshairs. Timing matters. If you want to benefit, you can’t wait until after the window slams shut.

Did you know that most hardworking Americans are overpaying on their taxes? Meanwhile, the wealthy use little-known legal strategies to keep more of their money.

With the Patriot Tax Loophole, you could reduce your tax burden, protect your wealth, and secure a better financial future—all legally and ethically.

Our FREE 2025 Wealth Protection Guide reveals exactly how this works and how you can take advantage before the government closes this loophole.

⚠️ This information won’t be available forever—claim your free copy now!

Trump’s Big Middle East Bet

While America bleeds money at home, Donald Trump is making global headlines.

He’s announced a sweeping Gaza “peace plan” — promising to settle one of the world’s most intractable conflicts. On the surface, it sounds historic. But experts are deeply skeptical. The region’s history is littered with broken accords, failed negotiations, and unintended escalations.

If this plan falters, the ripple effects won’t just be political. Oil markets could spike, defense spending could surge, and global investors could be thrust into another cycle of fear and volatility.

Markets hate uncertainty. And right now, America is exporting it.

Israel-Iran WAR Could Destroy Trump's PresidencyThe missiles are already flying.

Israel and Iran are now in direct military conflict — and this couldn't have happened at a worse time.

Trump is already dealing with Biden's $34 trillion debt bomb AND now a Middle East war.

This is exactly what the "resistance" has been waiting for.

While Americans watch the conflict on TV, they're hoping you won't notice what's really happening:

The Israel-Iran war isn't just about the Middle East. It's creating the economic crisis that could define Trump's entire presidency.

INSIDE OUR FREE CRISIS GUIDE:

→ Deep State's Last Stand — Why the first 100 days could trigger unprecedented market chaos as they resist Trump's agenda

→ The Fed's Power Play — How Powell could weaponize interest rates to block Trump's recovery plans (war gives them perfect cover)

→ Banking Crisis 2.0 — Why more banks will likely fail during this chaotic period

→ The Dollar's Critical Test — Foreign nations are preparing to challenge the dollar's dominance during the crisis

PLUS — The steps to take in the next 90 days to position your wealth like the central banks are doing.

THIS ISN'T ABOUT POLITICS. THIS IS ABOUT PREPARATION.

The conflict has already started affecting markets.

Don't wait to see how much worse it gets.

Get Your Free Presidential Transition Guide Now »

Second Wave 🌊

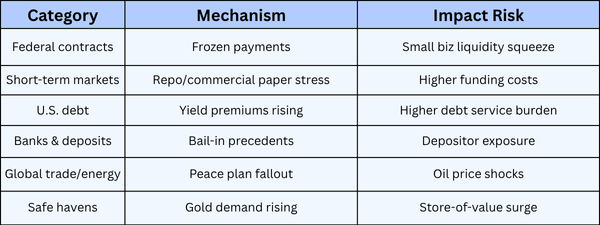

Why is the combination of a government shutdown + global gambits so dangerous? Here’s what’s already happening beneath the headlines:

- Federal payment delays. Contractors and small businesses relying on government work are starved of cash flow — raising default and bankruptcy risks.

- Stress in short-term funding. Money markets (repos, commercial paper) see widening spreads, making short-term borrowing more expensive and less available.

- Debt pressure. Investors may demand higher yields on Treasuries, driving up U.S. debt servicing costs and shrinking fiscal space.

- Municipal & pension strain. Frozen federal flows and asset drawdowns weigh on local governments and pension obligations.

- Bail-in mechanics. In moments of banking stress, deposit-to-equity conversions are already legal in some frameworks — a risk magnified when trust evaporates.

- Commodity & FX volatility. Failed peace deals or rising tensions can spike oil and gas prices, driving global inflation shocks.

- Flight to “hard” assets. Gold, silver, and physical stores of value gain traction whenever confidence in digital or government-backed assets falters.

- Consumer confidence collapse. Missed paychecks and political paralysis crush household sentiment — the fastest way to slow consumption and corporate profits.

Individually, these are serious. Together, they form a cascade — one failure amplifying the next.

🌊 Whale’s Fact Break

A blue whale can exhale at over 200 miles per hour — enough to fill a swimming pool with vapor in seconds. On the surface it looks calm… beneath it, a force few comprehend. Markets work the same way: slow structural shifts that suddenly release explosive energy.

Data Snapshot 📊

Top Picks

💲 This $85 Trillion Shift Could Be the Last Retirement Strategy You’ll Ever Need - ad by Behind The Markets

🚨 A financial strategy that allows Americans to move retirement savings into a stable, time-tested alternative, tax- and penalty-free. - ad by American Hartford Gold

📖 Free Crypto Revolution book from hosts of the world’s largest crypto podcast, CRYPTO 101! - ad by Boardwalk Flock

📋 Get Hugh Grossman's The “Daily Payout” Plan With a 91% win-rate on their trades! - ad by Eagle Pub

🐋 Whale’s Final Word

A shutdown isn’t just politics — it’s a stress test for the entire system. Layer in geopolitical gambles, and you no longer face “temporary noise”… you face structural risk.

Remember: while headlines distract, deeper currents are already changing the market’s course. Protect your liquidity. Diversify into assets that can’t be frozen with a line of code.

- Whale Investor 🐋