🐋 Whale’s Insight: Hands Down One Of the Best Credit Cards Of 2025

Take advantage of this offer - learn how to apply now >

If you have outstanding credit card debt, getting a new 0% intro APR credit card could help ease the pressure while you pay down your balances.

On top of all that, this top credit card offers an insane 5% cash back perk that gets matched after your first year. That's up to 10% back on qualifying purchases!

Click through to see what all the hype is about.

Good day, dear reader — Whale Investor here.

Beneath the dazzling surface of record market highs and the daily swirl of political theater, millions of American households are quietly navigating rising financial strain. Inflation eats away at purchasing power, wages remain stubbornly stagnant, and record household debt drags down resilience. In this environment, lenders have begun offering lifeboats — alluring 0% introductory APR credit cards and cash-back incentives that look like opportunities but carry deeper warnings.

This pattern is classic in economic cycles. When the tide pulls back, the wisest survivors find ways to float — sometimes only for a while. It’s a delicate dance between short-term relief and long-term risk, and understanding it is crucial to steering clear of harmful undertows.

🌊 The First Wave: Why 0% APR Offers Are Flooding the Market Again

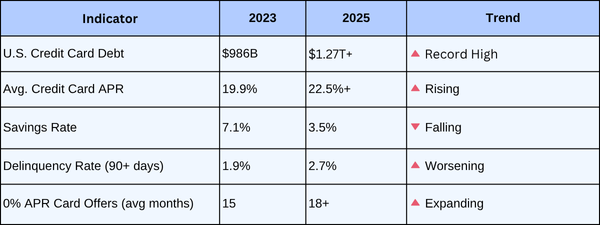

Recently, U.S. credit card balances surged beyond $1.2 trillion, reaching all-time highs not seen since the last credit expansion. Meanwhile, average credit card interest rates have climbed above 22%, reflecting tightening monetary policy and lenders’ increasing risk premiums. Yet consumers, squeezed by inflation and limited wage increases, continue to juggle these balances, often resorting to 0% intro APR offers as a lifeline.

These offers act as financial oxygen — temporarily suspending interest charges and allowing cardholders to refinance high-cost debt. They often include generous cash-back match programs, designed not only to entice new customers but also to incentivize ongoing spending and balance shifting. It’s an elegant piece of behavioral finance wrapped in marketing, providing immediate relief while extending the consumer’s debt horizon.

For lenders, it’s a strategic move during tightening cycles — maintaining credit flow and spending velocity while delaying potential defaults. For households, it’s tempting and necessary, but carries the peril of deferred reckoning.

From my perspective, “In every cycle, relief arrives just before the reckoning. What matters is whether you use it to breathe — or to dive deeper.”

Deep Dive: Macro Forces and Unseen Currents

Zooming out reveals troubling macro trends underlying this dynamic. The consumer credit environment today is reminiscent of the early 2000s credit boom, but layered atop a far more complex inflationary backdrop. Back then, easy credit and suppressed inflation masked the accumulating risks. Now, inflation is elevated and persistent, hovering above 5%, while wages lag behind.

This creates a reliance on credit as a form of disguised income — a credit-dependent recovery fueled not by wage growth but by borrowing to maintain spending. Credit card refinancing offers the illusion of liquidity, granting consumers breathing room without extinguishing debt. However, it merely time-shifts obligations, often at increasing cost.

Data amplifies these concerns. Average credit card APRs rising beyond 22% are a silent tax on households. Delinquency rates, especially those over 90 days, are creeping up despite solid employment figures. Further, the national savings rate, which once offered a financial buffer, has fallen precipitously to around 3.5%, well below pre-pandemic levels. This thin margin for error amplifies vulnerability to economic shocks.

As one analyst observed, “For decades, America’s growth engine has run on borrowed time. Now, even time itself is being sold at 0% interest.”

Trump just signed an executive order that could make crypto millionaires overnight. While Biden tried to push for a Central Bank Digital Currency (CBDC) to control your money, Trump just KILLED it.

📈 No more government control over crypto.

📈 Wall Street is already making its moves.

📈 Bryce Paul just named the #1 coin set to explode in 2025.

Here’s what’s happening:

- J.P. Morgan, BlackRock, and hedge funds are diving in—before the public catches on.

- Bryce Paul has identified the one coin positioned for the biggest gains under Trump’s policies.

- It’s already seeing institutional backing—and it could surge any moment.

The last time crypto had this kind of support, early investors made life-changing money.

👉 Get Bryce’s full report for just $3 now!

P.S. This is the kind of opportunity that doesn’t come twice. Don’t wait—this could be the biggest crypto run of our time.

🌊 Whale’s Fact Break

Blue whales slow their heartbeat to two beats per minute when diving deep — conserving energy to survive pressure. In finance, managing debt works the same way: slow your pulse, steady your rhythm, and rise when the current calms.

Second Wave: Strategic Perspectives - Leveraging the Lifeline Wisely

With this context, 0% APR credit cards emerge as neither villains nor saints — but tools whose utility depends on usage.

When used strategically, they provide a valuable grace period to consolidate debt, restructure finances, or manage cash flow through difficult periods. The interest-free runway offers breathing room to plan, adjust, and stabilize without immediate cost.

However, the path is narrow and fraught with pitfalls. Deferred interest clauses may trigger substantial retroactive charges if balances aren’t cleared on time. Promotional periods are often fixed, expiring without warning. Behavioral research shows consumers tend to overspend when rewarded with cash-back incentives, risking further entanglement in debt cycles.

More broadly, surging consumer credit signals shifts in market dynamics that often precede liquidity contractions or broader financial distress. Households increasing leverage become one of the initial fault lines in economic downturns, as witnessed in prior recession cycles.

From the viewpoint of an institutional observer and market veteran, I emphasize: “The smartest investors I know don’t fear the tides — they prepare for them. When the current shifts, those who already moved their weight stay afloat.”

Data Snapshot 📊

Top Picks

⏳ 2025: Retirement Age Will Rise—Are You Ready? - ad by American Alternative Assets

🏦 Top Five U.S. Banks Preparing for Massive Change to Checking & Savings Accounts? - ad by Brownstone Research

🆓 Grab your Free Bitcoin! Just attend one of this week’s exclusive workshops, immerse yourself in the knowledge, and complete a short quiz completely free – no catch, no purchase necessary - ad by Goodrise

🛠️ The hidden scandal behind CBDC - ad by American Alternative Assets

by Finance Buzz

Pay no interest until 2027! Earn top-notch cash back rewards. No annual fee.

🐋 Whale’s Final Word

The current financial landscape offers both relief and warning. The expansion of 0% APR cards reflects lenders’ recognition of systemic pressure and households’ need for breathing room. But these tools demand care — missteps can deepen leverage and exposure.

Discipline, timing, and foresight become paramount. This era rewards those who balance liquidity with prudence and who view credit not as free money but as a timed resource.

As debt tides continue to rise in the economy, controlling your rhythm and understanding the currents beneath can be the difference between survival and struggle.

Swim free, and APR free,

- Whale Investor 🐋