🐋 Whale’s Insight: Government Shutdown - and the Hidden Agenda Behind It

The Curtain Falls on Washington 🎭

Good day, dear reader. Whale Investor here.

Another government shutdown has just slammed into America. To most, it looks like a political squabble — Democrats vs. Republicans, budgets vs. egos. But if you’ve followed history, you know it’s rarely “just politics.”

Each shutdown leaves cracks in the system. Cracks that aren’t visible at first… until markets shake, services freeze, and ordinary citizens realize their safety net is paper-thin.

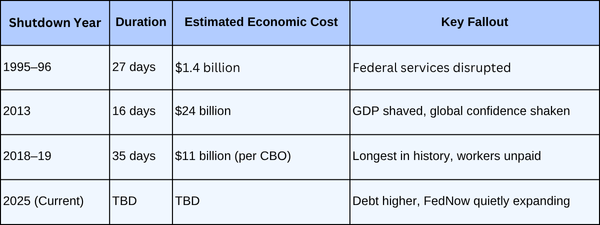

This isn’t the first time, and history shows us how damaging these shutdowns can become. In 1995–96, the longest shutdown of its era rattled confidence in U.S. leadership. In 2013, the standoff over Obamacare cost the economy an estimated $24 billion. And in 2018–19, the record 35-day shutdown left federal workers lining up at food banks.

But here’s the hidden thread: every time Washington fights, the real machinery of control quietly moves forward in the shadows.

Deep Dive 🐳

While America’s eyes are locked on the theater of a shutdown, the Federal Reserve has been quietly rolling out the FedNow system — the infrastructure for a Digital Dollar.

They’ll tell you it’s about “speed” and “efficiency.” The reality? Every transaction could soon be logged, traced, and potentially restricted. Programmable money means programmable freedom.

Ask yourself: if they can shut down the government for weeks, what stops them from shutting down your account with a single line of code?

And it doesn’t stop there. Historically, shutdowns are a stress test for the financial system. Credit ratings wobble. Investor confidence sinks. In 2011, just the threat of a default during a shutdown led Standard & Poor’s to strip America of its AAA rating for the first time in history.

Now fast-forward to today: rising debt, fragile banks, global uncertainty. This time, the fallout could be far worse.

The Digital Dollar Is No Longer a Theory -

It's Already Here...

While America's distracted, the Fed quietly launched FedNow - a 24/7 instant payment system that's laying the foundation for a U.S. Central Bank Digital Currency (CBDC).

They claim it's about speed and convenience...

But beneath the surface, a system of surveillance and control is being built impacting our financial privacy and freedom.

Ask yourself:

- If every transaction becomes digital, what happens to your privacy?

- Could "programmable money" be used to limit how - or where - you spend?

- Could access to your savings or retirement be limited by someone else's rules?

This isn't hypothetical.

FedNow is already live. The rails are in place.

And even Trump - who once criticized digital currencies - is now supporting a national crypto reserve... and has adopted projects like Trump-themed tokens.

The writing is on the wall. Once this system is fully operational, opting out may no longer be an option. If adoption becomes widespread, preserving financial alternatives could become impossible.

That's why this free guide is so urgent. It reveals the real risks - and what you can do right now to protect your financial freedom before it's too late.

Get the guide now. While you still can.

The Hidden Bank Trap 🏦

And here’s where it gets darker.

Amid shutdown chaos, some U.S. banks are already closing branches. Others are preparing for liquidity squeezes. But few Americans realize that under “bail-in” laws, banks can legally seize a portion of your deposits to cover their own crises.

That’s not a conspiracy theory — it’s written into the Dodd-Frank Act. Cyprus used it in 2013. Other nations have quietly embedded similar rules. And now, while headlines scream about shutdown drama, the same system quietly looms over your savings.

Which is why right now, protecting what’s yours isn’t just smart — it’s urgent.

Do You Bank With These Banks?

Because if you do…

They could legally steal your money — and there’s nothing you could do to stop it.

Sounds extreme? It’s not.

Under Obama’s Dodd-Frank Act, banks have the legal right to freeze your accounts and use your savings to bail themselves out.

And now, 63 U.S. banks are teetering on the edge — buried under $517 billion in unrealized losses.

This isn’t a warning.

It’s your last chance.

📉 FDIC is in crisis mode behind closed doors.

When the next collapse hits, your dollars could be locked down… or wiped out.

But smart Americans are already getting ahead of it.

They’re quietly moving their savings out of the system — and into real assets that can’t be printed, seized, or frozen.

Gold. Silver. Hard stores of value — not paper promises.

Priority Gold is giving away a Free Wealth Shielded Guide that reveals exactly how to do it — fast, legally.

Inside:

✔️ 3 urgent moves to shield your retirement

✔️ How to legally exit the banking system

✔️ What to own before the collapse dominoes fall

Second Wave 🌊

Shutdowns aren’t new. But the difference today is convergence: historic debt, a fragile dollar, banks under pressure, and digital rails already in place for FedNow.

In 1976, the very first shutdown lasted just 10 days. In 2013, it was 16 days. In 2019, it was 35. Each one has been longer, harsher, and more destabilizing than the last. History doesn’t just rhyme — it escalates.

Add to that the rise of “programmable money,” and the stakes are no longer political games. They’re about control of your financial freedom.

🌊 Whale’s Fact Break

Did you know? A sperm whale can slow its heart rate to just two beats per minute when diving deep. It’s a survival trick — conserving oxygen while navigating the depths.

Sometimes, in markets and politics, survival also means slowing down, conserving, and preparing for what’s below the surface.

Data Snapshot 📊

Top Picks

💲 "A CBDC would give the federal government absolute control over your money." Claim your free guide that shows how to legally protect your cash. - ad by American Alternative Assets

🚨 RFK Jr’s Terrifying 2025 Alarm Shakes Washington. - ad by NewMarket Health Publishing

📖 Free Crypto Revolution book from hosts of the world’s largest crypto podcast, CRYPTO 101! - ad by Boardwalk Flock

💳 Pay Off Your Credit Card Debt. Get A Free Estimate. - ad by Simple Debt Solutions

🐋 Whale’s Final Word

Shutdowns end. Markets recover. But the deeper moves — like FedNow, Digital Dollar rails, and banking bail-in laws — are permanent shifts.

Stay alert. Stay nimble. And remember: while the crowd watches the stage, the real action is always happening behind the curtain.

- Whale Investor 🐋