🐋 Whale’s Current: 500 Years of Banking Led Here - Get Your 0% APR Card Today

The Origins of Banking 🌊

Good day, dear reader — Whale Investor here.

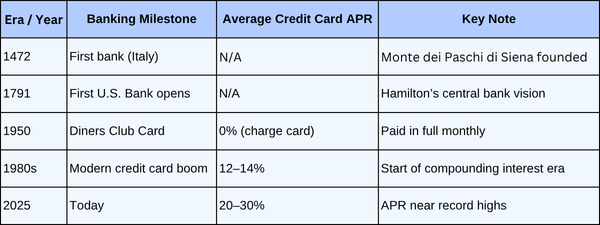

Long before the flashing tickers of Wall Street and the rise of megabanks, the first prototypes of banks were born in ancient Mesopotamia. Clay tablets recorded deposits of grain, and temples doubled as “safe vaults.” Fast forward to 1472 — Monte dei Paschi di Siena opened in Italy, and it still exists today, making it the oldest surviving bank.

America’s banking system came later. The First Bank of the United States opened in 1791 under Alexander Hamilton’s vision — a controversial idea at the time, but one that laid the foundation for America’s financial dominance. Since then, banks have grown from marble halls and handwritten ledgers to digital empires holding trillions.

But the mission has always been the same: control the flow of money. And while banks once made fortunes storing gold, today they thrive by charging you interest — especially through credit cards.

Deep Dive

Not all banks are the same. Commercial banks take deposits and issue loans. Investment banks raise capital and fuel Wall Street deals. Central banks, like the Federal Reserve, steer entire economies. Each plays a role, but all rely on one powerful principle: leverage other people’s money.

Credit cards were the modern twist. Before plastic, consumers relied on charge accounts with local stores, sometimes recorded in ledgers that carried no interest. But in the 1950s, Diners Club introduced the first multi-merchant card. By the 1970s, Visa and Mastercard were globalizing the model. What started as convenience quickly turned into a trap — with double-digit APRs locking families into cycles of debt.

Here’s the harsh truth: in the 1980s, average APRs were around 12–14%. Today, many cards hit 20–30%. Banks don’t want you to notice — because that interest is their lifeblood.

But imagine if you could step outside the trap. Imagine knowing how to freeze your interest for nearly two years — every payment going toward balance, not bank profits. That option exists today, if you know where to look.

Credit card interest is draining your bank account.

But there’s a legal way to freeze it cold for 21 months — starting today.

No gimmicks. No annual fee.

Just a top-rated card with a 0% intro APR that lasts nearly two years.

🔒 Learn how to apply now >

Second Wave 🌊

Why does this matter now? Because household debt is at record highs. According to the Federal Reserve, Americans owe over $1.1 trillion in credit card balances — and rising. Inflation means essentials cost more, while interest rates punish anyone who borrows.

Yet at the same time, financial tools exist that can flip the script. Just as banks evolved from temples to trillion-dollar titans, you can evolve how you handle debt. Instead of bleeding money to interest, you can redirect it — toward freedom, savings, and new opportunities.

The wealthy know how to use leverage. Everyday investors should too.

🌊 Whale’s Fact Break

Did you know the sperm whale’s head can hold up to 500 gallons of oil-like fluid once prized for lamps? Just like whales once lit the seas, banks once claimed to “light” economies — though often at your expense.

Data Snapshot 📊

Top Picks

🤖 Nvidia’s AI Truck Tech: What Analysts Are Watching - ad by Weiss Ratings

🚨 A financial strategy that allows Americans to move retirement savings into a stable, time-tested alternative, tax- and penalty-free. - ad by American Hartford Gold

📖 Free Crypto Revolution book from hosts of the world’s largest crypto podcast, CRYPTO 101! - ad by Boardwalk Flock

📋 Get Hugh Grossman's The “Daily Payout” Plan With a 91% win-rate on their trades! - ad by Eagle Pub

🐋 Whale’s Final Word

Banks have always thrived by charging rent on money. But just because the system is built that way doesn’t mean you have to play by their rules. Remember: even the strongest tide can be turned with the right current.

- Whale Investor 🐋