🐋 Whale’s Brief: $15,000 Gold—Rumor or Roadmap?

The dollar is already down 10% in 2025—its worst start since 1986. And now a $3.3 trillion spending bill is pouring gasoline on the fire.

EO 14024 is still in effect. 40% of global banks are ditching the dollar for gold. Even Elon Musk is warning what comes next could gut your savings, retirement, and financial freedom.

Don’t wait until Washington’s next move hits your bottom line.

Grab your FREE Wealth Guide now.

Good day, dear reader — Whale Investor here.

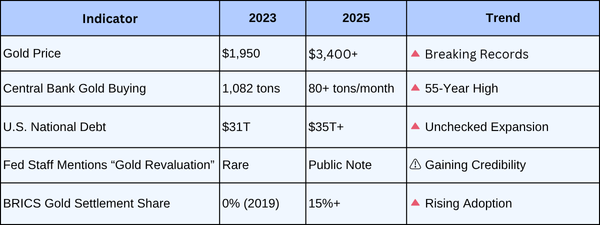

Something immense is moving beneath the surface of the global monetary system. Confidence — not currency — is the true anchor of economies, and that anchor is showing strain. The latest tremors are unmistakable: record central bank gold purchases, quiet Federal Reserve discussions on gold valuation, and the BRICS nations’ forging of commodity-backed alliances. These developments hint at the early contours of a monetary reset, one not born from panic but from the quiet, purposeful preparation of those who see what’s coming before the tide reaches shore.

🌊 The First Wave: The Rising Crest of a Gold Revaluation

Central banks are buying gold at the fastest pace in 55 years, consistently acquiring over 80 tons per month. This surge is unprecedented in modern history and signals more than a mere defensive maneuver. Recently, the Federal Reserve circulated an internal discussion paper on the potential for a gold revaluation — a subject once deemed fringe but now gaining serious consideration amidst mounting fiscal pressures.

Why now? The United States carries over $35 trillion in debt, global geopolitical realignments are shifting trade and monetary flows, and inflation refuses to yield. These forces threaten traditional fiat architecture, pushing custodians of global reserves toward assets that reliably preserve value.

This discussion is not speculation; it’s monetary contingency planning. Financial systems, like oceans, seek new equilibrium when existing currents become untenable. Revaluing gold could restore balance sheets without the catastrophic shock of outright default.

The gravity of this development cannot be overstated: “What was once a fringe idea is now policy conversation — and when central banks move in unison, history tends to follow.”

Deep Dive: Anchoring in Monetary History

History provides crucial context for this unfolding story.

In 1933, President Franklin D. Roosevelt ordered gold confiscation followed by significant revaluation under the Gold Reserve Act, transforming economic landscapes overnight. The Nixon administration's 1971 decision to close the gold window severed dollar convertibility, unleashing fiat expansion and subsequent inflation tides.

More recently, the 2008 financial crisis triggered a flood of quantitative easing — an unprecedented fiat expansion that stretched faith in paper money to historic limits.

Each event began quietly, a shift from below, then rapidly redefined global wealth distribution. A revaluation of gold to $15,000 per ounce — a figure estimated by respected macro analyst Clive Thompson — could unlock trillions of dollars in collateral. This could partially restore central bank solvency while effectively devaluing existing fiat currencies in real terms, forcing markets to recalibrate.

Compounding the urgency, the global trust in the dollar weakens as BRICS nations align commodity trade with gold or the yuan. U.S. political interference at the Fed erodes credibility abroad, underscoring the cumulative nature of this pressure.

Viewed broadly, this scenario resembles a controlled burn — an engineered financial reset masked as policy innovation, stoking liquidity and confidence by recalibrating the ledger beneath the storm.

Is the Fed Preparing a $15,000/oz Gold Reset?

Central banks are buying gold at the fastest pace in 55 years — here's why it matters to you.

For decades, the Federal Reserve promised Americans the same thing: "Trust us — your money is safe."

But confidence in the dollar is collapsing… and even insiders at the Fed are quietly discussing a plan that could change everything you've worked for: a gold revaluation.

The Signals Are Everywhere

Gold has already broken through

Gold has already broken through $3,400/oz, and central banks are on a buying spree — accumulating over 80 tons of gold per month, the fastest pace in 55 years.

The Fed recently released a staff note openly discussing gold revaluation — something dismissed as "conspiracy theory" just a few years ago.

Former Swiss banker Clive Thompson estimates gold could be revalued at $15,000/oz, unlocking nearly $4 trillion in liquidity.

Crescat Capital's Tavi Costa suggests even higher theoretical levels — between $25,000 and $55,000/oz — if the Fed sought to restore balance sheets to historical norms.

If central banks — the very institutions that print money — are abandoning the dollar and hoarding gold, shouldn't you be asking why?

P.S. Don't wait for the Fed's next move — click here to secure your guide today

The Dollar's Foundation Is Cracking

- The U.S. is drowning in $35 trillion+ of national debt.

- Every "solution" involves creating more dollars — further devaluing the ones you already hold.

- BRICS nations are openly building a post-dollar financial system backed by commodities and gold.

- Political interference at the Fed has shattered the myth of independence — weakening global trust in America's currency.

Download Your Free Wealth Protection Guide Now

If you have $50,000, $100,000, or more in savings, an IRA, or a 401(k), your nest egg is directly tied to the dollar's fate.

What happens if the Fed flips the switch? Overnight, a revaluation of gold could mean an instant repricing of the dollar — and devastating consequences for unprotected retirement accounts.

Why Gold & Silver Are the Proven Hedge

- In the 1970s, runaway inflation pushed gold up over 600%.

- In 2008, while Wall Street crumbled, gold doubled in value.

- Today, even central banks classify gold as a Tier-1 reserve asset — the same level of safety as cash, while silver adds the extra advantage of rising industrial demand.

Your Next Step

At True Gold Republic, we've created a FREE Wealth Protection Guide to help you act before it's too late.

Inside, you'll learn:

- The #1 warning sign the Fed may revalue gold.

- Why central banks are dumping U.S. Treasuries and buying gold.

- Proven ways to protect your IRA, 401(k), or savings from inflation and currency decline.

Plus — get our Bonus Report: The De-Dollarization Blueprint and discover:

- How the global move away from the dollar is accelerating.

- What China and Russia's strategies mean for U.S. investors.

- Simple steps to prepare your wealth now.

Download Your FREE Wealth Protection Guide+ Bonus De-Dollarization Blueprint

A+ BBB rating. Client-first service. Secure, insured storage options.The Window Is Closing

Financial resets happen overnight — when trust disappears.

When the headlines hit, it's already too late.

Protect your retirement. Protect your savings. Act now.

🌊 Whale’s Fact Break

Humpback whales navigate entire oceans using Earth’s magnetic fields — subtle signals invisible to the surface eye. In finance, the same rule holds: those who sense the field shift adjust course long before the horizon changes color.

Second Wave: Strategic Depth for Investors

Whatever central banks undertake, individual investors are wise to consider parallel strategies. Gold and silver continue to function as real stores of value amid declining faith in fiat systems.

History’s ledger offers guidance: during 1970s inflation, gold rose over 600%, and during the 2008–2009 crisis, it doubled—demonstrating its unique asymmetric defense profile against policy-driven currency debasement.

Readers exploring practical protection steps, such as those highlighted in the True Gold Republic Wealth Protection Guide, align their personal strategies with sovereign reserve logic — anchoring capital in tangible assets before the monetary current shifts decisively.

Remember: “The deepest shifts happen in silence — long before the surface feels the wave.”

Data Snapshot 📊

True Gold Republic

Discover the IRS-approved escape route for your IRA—before Washington shuts it down.

🐋 Whale’s Final Word

We are not witnessing the collapse of money — but its redefinition. Gold’s resurgence is not nostalgia for a lost era; it is a necessity born of eroding trust. The world is recalibrating its anchors; the dollar’s supremacy will no longer be assumed.

The prudent course is composure and preparation: those who wait for confirmation read the headlines too late, while those who act on the currents see opportunity unfold.

Swim prepared,

- Whale Investor 🐋